Explore use cases pertaining to Financial Services where machine learning is being used to solve complex business problems:

Financial services institutions are adopting AI/ML solutions to gain a competitive edge in this changing financial services market. Customers are pushing institutions to provide services in all forms of banking with the need of speed. Understanding needs in the marketplace and to refine processes to make quicker decisions smartly allows Financial Services institutions to generate maximum value and retain customers.

Risk Management

Risk Management is not just compliance. Powering every operational task, financial services institutions need to Build, Secure, Validate, Monitor models taking into account volatility while predicting patterns, anomalies and correlations in huge data sets within the banking systems.

Fraud Analysis

Efficiently analyze huge transactional data at scale with accuracy and predict with accuracy transactions that are abnormal. Predicting fraudulent behavior and helping prevent these transactions from flowing through, helps institutions with providing better service and lower the impact to its bottom line.

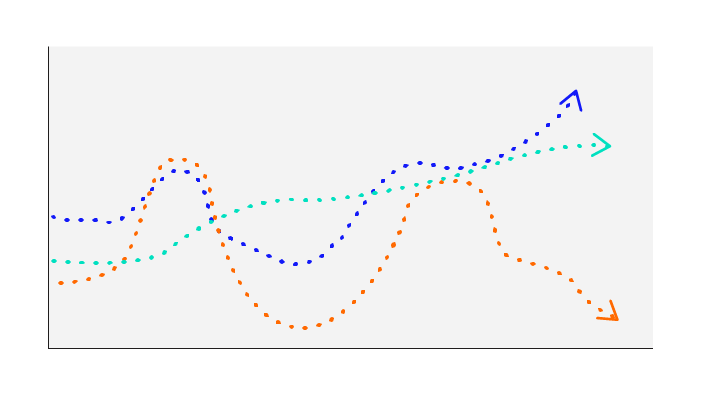

Stock Price Prediction

Use machine learning to power models that can predict patterns and changes to pricing based on several real time factors and historical data. Outcomes can help institutions to initiate beneficial trades based on set customer risks at precision in a timely real-time manner. Use of ML powered models can deliver better results.

Customer Support

Predict customer behavior and interactions with powerful insights to win customers throughout the Omnichannel Banking Experiences. Customer journeys can be understood at mass and complex fractured customer experiences can be handled with accurate solutions to enhance the customer experience.

Product Recommendation

Meet customers’ high expectations by scaling personalized experience throughout the Omnichannel Banking Experience. Drive ROI, satisfaction targets and retention rates by understanding customer journeys to unlock patterns at scale; while designing and automating campaigns that deliver offers and rewards that meet individual customer needs.

Evaluation

Machine learning models can be used to evaluate creditworthiness of customers taking into account payment history and patterns by credit scoring while making lending decisions. Models can be built taking into account several banking factors and evaluations can help relevant teams to make decisions quickly.

Operations

Streamline operational tasks of inputting customer data, payment processing, data retrievals and information extraction by using ML models. Information verification, classification and processing can be done at scale allowing financial services institutions to better utilize labor on building customer satisfaction, drive ROI and lower costs.

Real Estate

Use geospatial data analytics to identify critical new prospective locations and where to upgrade existing assets based on customer location, competitor presence, market preferences to optimize business outcomes.

Schedule a Workshop for your Team

Check out the growing list of banking and financial services companies using Kubeflow in production

Banking/Financial Services

Financial Services

Banking/Financial Services

Banking/Financial Services

LTI is a global technology consulting and digital solutions company with operations in 32 countries helping more than 400 clients accelerate their digital transformations using LTI’s Mosaic platform.

Banking/Financial Services

TatvaSoft offers software development services on diverse technology platforms, like Microsoft, Java, PHP, SharePoint, Biztalk, Open Source, Big Data, BI, & Mobile.

Banking/Financial Services

INDmoney is a Super Money App that brings all your family’s finances to one place. The Mobile App automatically organizes your finances, helps you plan your goals, and uses machine learning to help you save and invest at Zero commissions.

Banking/Financial Services

Financial Services